If you lived in Belgium in 2022 or arrived in the country last year, you might have already received an online notification from the Belgian authorities that your 2022 tax return can be submitted. Tax-on-web, the platform to file your taxes online, is available since 26 April.

The 2023 return covers the period between 1.01.2022 and 31.12.2022, unless you arrived later in the year or have left Belgium before the year-end. While the online tax form can already be submitted, the paper form (‘brown envelope’) is still on the way and should arrive in your mailbox in the next few weeks.

Traditionally, Tax-on-Web remains accessible until 15 July 2023. If you would still prefer the traditional method of filing on paper, the form will normally mention a filing deadline.

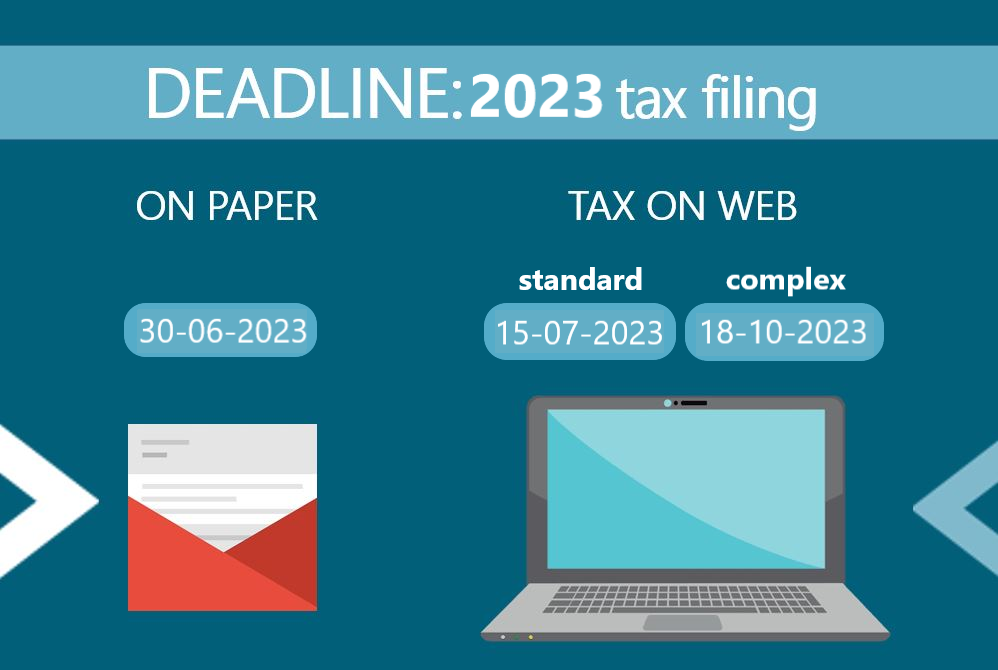

This year, the tax filing deadline depends on the type of earnings and the complexity of the return.

| DEADLINE | Standard filing | Complex filing |

| On paper | 30 June 2023 | 30 June 2023 |

| Online | 15 July 2023 | 18 October 2023 |

A tax filing is considered complicated if it includes one or more of the following types of income:

- Company director remuneration

- Self-employed income

- Business income

- Foreign earned income

More taxpayers will receive a so-called ‘tax return proposal’ this year as well, based on the info that is readily available by the tax authorities. It is a noble attempt to facilitate the filing process, but often contains errors. It is therefore useful to check it and not simply accept what is mentioned in the pre-completed return. For example, foreign earnings and business income will never be included in the proposal, so this would always require your personal input.

If you need more time to prepare your filing or prefer to delay paying your taxes, you can file through an accountant or tax advisor who is able to submit online until 18 October 2023 (if your filing for 2022 can be considered complicated). As the online filing system often experiences errors and irregularities, the Belgian authorities might extend the deadline, but that traditionally happens the very last minute.

If you do not agree with the ‘tax return proposal’, you or your tax advisor only have time to respond until 15 July 2023, so the standard filing extension until October does not apply here.

The authorities also made a promise this year that if your tax return is filed before 31 August 2023, you will be able to benefit from a quicker refund or have the option to pay your taxes later.

If you need professional help to prepare your 2023 tax return, your foreign bank account reporting and/or foreign real estate reporting, do not hesitate to reach out to us!