If you qualify as a non-resident or an expat and are considered taxable in Belgium only on your Belgian domestic income, you should know that your access to certain tax allowances and personal deductions may be restricted. Apart from obvious budget reasons, it is based on the idea that non-residents will normally benefit from these in their country of residence.

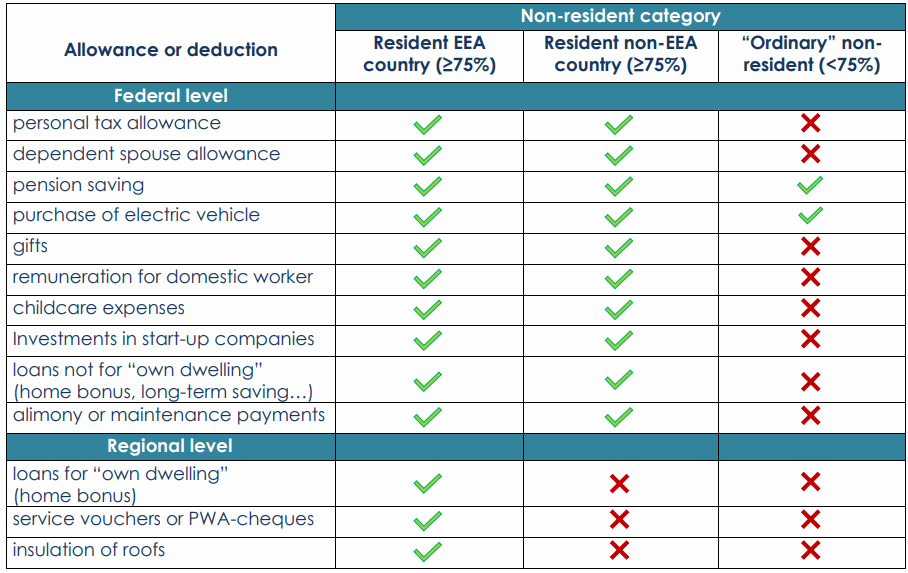

For several years already, a distinction is made between three types of non-resident taxpayers: (i) ‘ordinary’ non-residents (who do not earn 75% of their global professional income in Belgium); (ii) residents of EEA (European Economic Area) member states who earn 75% or more of their professional income in Belgium; and (iii) residents of non-EEA countries who also earn 75% or more of their professional income in Belgium.

EEA residents are always entitled to the standard deductions determined at federal, as well as at regional level, while non-EEA residents are only entitled to the federal tax deductions and miss out on the tax deductions at the regional level.

Under the (old) expat status, foreign nationals would also fall into any of the above non-resident categories depending on whether they travel more than 25% of their working time (‘foreign travel exclusion’) and whether their home country is located in the EEA or not.